CuraDebt has been a debt relief company that aids individuals as well as local businesses since 2000. They give a series of services including financial debt negotiation as well as loan consolidation, tax financial obligation alleviation, and also business financial obligation loan consolidation. in the post we talk about CuraDebt review Everything about CuraDebt you need to know

CuraDebt can aid you if you are battling to settle your debts. They use legal financial obligation relief that can conserve your money.

A financial debt alleviation program can aid you with unsafe financial obligations like credit cards, individual funding, as well as other financial obligations. The debts may have been accumulated as a result of a number of factors, such as divorce, overspending, or various other problems. Maybe you are becoming delinquent or receiving financial institution phone calls. Or, maybe you recognized that paying the minimum repayment would allow you to pay off your debt numerous times while keeping the equilibrium the exact same.

The internal revenue service as well as State now have much more civil liberties to gather tax obligation financial debts. Tax obligation debts can be the result of a previous tax preparer’s errors, an under-withholding, a failure to report pay-roll tax obligation withholdings, identification theft, or a tax obligation audit.

CuraDebt’s team is incredibly expert and can aid you with tax obligation and financial obligation issues such as audit defense. They likewise provide complex solutions, partial settlement plans, uses in concession, innocent spouses, and service tax liens.

It is essential to obtain things right from the beginning, whether it’s for unprotected debt relief or tax financial debt resolution. By having an experienced group in your corner, you can be certain to attain the most effective outcomes. Testimonials from customers, rankings by trusted agencies, and the lack of currently unsettled issues are likewise crucial standards.

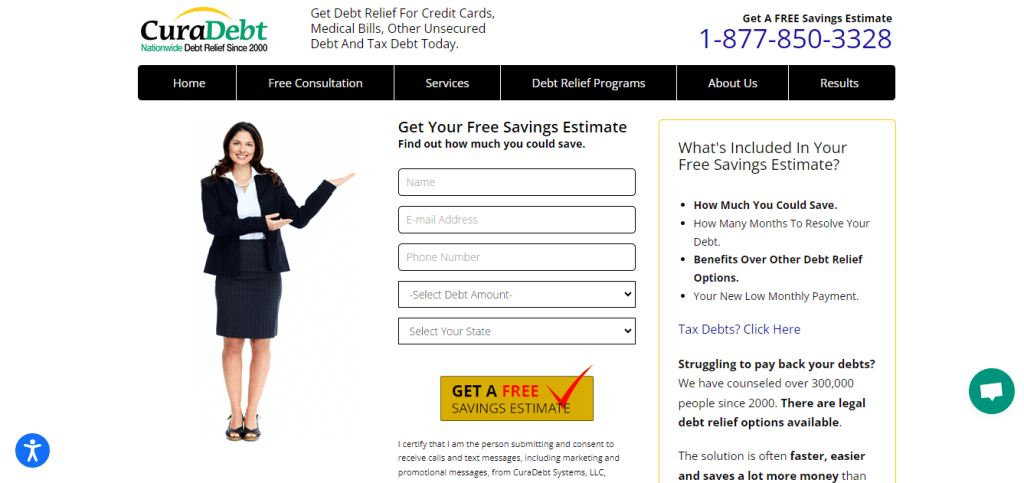

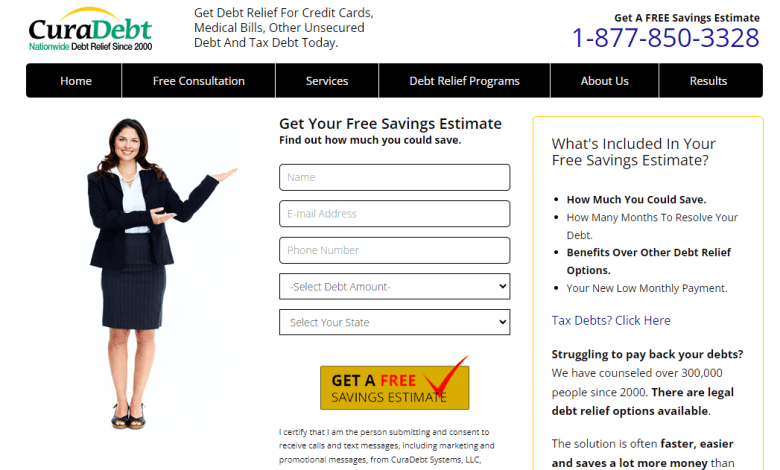

CuraDebt supplies a 100% confidential and no-obligation financial debt assessment to aid you learn just how much you can conserve, how much time it will take to pay off your financial obligations, what other alternatives are offered, and just how much your brand-new monthly settlement is.

CuraDebt can assist you if you are dealing with financial obligations. You can be ensured that they have extensive experience with debt relief and resolution of tax obligation debt.

Features of CuraDebt

CuraDebt has a number of features that can assist small companies and individuals manage their financial debts as well as getting back on the appropriate track economically. CuraDebt offers a number of key attributes.

- Financial Debt Arrangement – CuraDebt offers debt settlement solutions that enable you to resolve financial debts at a reduced quantity than you owe. Their seasoned arbitrators collaborate with lenders to decrease what you owe. This will certainly help you leave debt quicker.

- CuraDebt can help you if you have several high-interest debts. They will deal with your financial institutions in order to consolidate every one of your financial obligations as well as make one monthly settlement that is manageable, normally at a lower price.

- CuraDebt provides tax obligation financial debt alleviation for people in addition to small companies. Their group of skilled experts can help you in working out with the IRS and also state tax authorities for a decrease in the amount you owe, or establishing a settlement routine that is convenient for you.

- CuraDebt can assist you with your business debt combination if you are a small business proprietor that is battling to repay the financial debt. They will certainly deal with your lenders in order to consolidate every one of your business financial debts as well as make one regular monthly payment that is manageable. This can aid you come back on the best track economically.

- CuraDebt gives a free appointment that is not bound by any type of commitment to help you better understand your financial obligation alleviation choices. Their group will certainly analyze your monetary situation during the consultation as well as make individualized recommendations on exactly how to run away from debt.

- CuraDebt has a team of experts with over twenty years of experience in helping small companies and also individuals handle their financial debt. They have a record of tried and tested success as well as are dedicated to helping clients accomplish economic self-reliance.

CuraDebt is an extensive device that aids individuals and also local business proprietors manage their financial debts as well as coming back on the ideal track. Their seasoned group will aid you locate the very best option for your financial circumstance, whether you are trying to find financial debt negotiation, debt consolidation, tax obligation financial debt alleviation, or organization financial obligation combination.

Curadebt Review Benefits

CuraDebt provides several benefits for individuals and local businesses that are battling financial debt. CuraDebt uses numerous advantages for individuals and small services having problems with financial obligations.

- CuraDebt uses debt alleviation solutions that can help you repay your financial debts quicker and better than if you attempted to do so by yourself. Their group of skilled professionals can bargain with lenders to lower what you owe and also produce a payment timetable that is convenient for you.

- CuraDebt assists you lower your monthly repayments by consolidating financial obligations as well as negotiating with financial institutions. This makes it easier for you to handle your finances.

- CuraDebt has a team of experts with over two decades of experience in helping small companies as well as people manage their financial debt. They have a performance history of tried and tested success as well as are dedicated to aiding clients to achieve monetary self-reliance.

- CuraDebt provides a totally free assessment that is not bound by any responsibility to assist you in better recognizing your financial debt relief options. Their group will analyze your economic scenario throughout the consultation and make personalized referrals on how to get away from debt.

- CuraDebt offers tax obligation financial obligation alleviation for people along with little businesses. Their group of knowledgeable professionals can help you in discussing with the internal revenue service and state tax authorities for a decrease in the amount you owe or establishing a settlement routine that is convenient for you.

CuraDebt can assist you with your service financial debt if you are a small business proprietor who is struggling to repay debt. They will function with your creditors in order to combine all of your organization’s debts as well as make one month-to-month settlement that is workable. This can aid you come back on the best track monetarily.

CuraDebt is a terrific tool to aid you reach economic flexibility. It can lower your financial obligation and lower your regular monthly settlements. You will certainly additionally obtain individualized solutions tailored to your economic situation.

CuraDebt offers financial obligation relief solutions for people and also small companies dealing with financial debt. CuraDebt supplies a range of services, including financial debt negotiation, combination, tax financial debt reduction, as well as company loan consolidation, to help customers accomplish monetary freedom and also obtain out of financial obligation.

Just how Curadebt functions

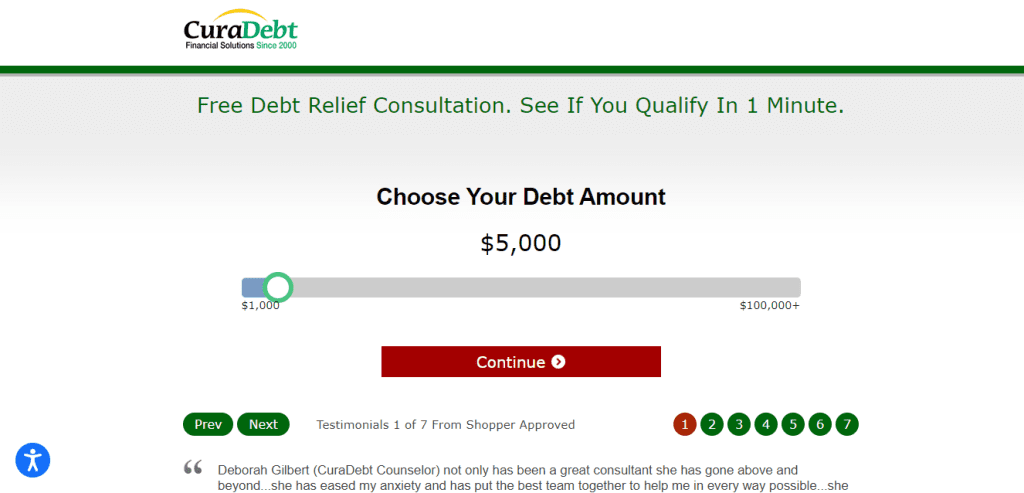

- CuraDebt supplies a cost-free consultation that is not bound by any responsibility to assist you in better understanding your debt alleviation options. Their team will examine your financial situation during the appointment and also make tailored suggestions on exactly how to leave financial obligations.

- Financial Obligation Analysis: CuraDebt performs a financial obligation analysis after the examination to establish what the very best action strategy is for your monetary scenario. This can consist of financial obligation negotiation or debt consolidation, tax obligation debt decrease, as well as service debt loan consolidation.

- Financial obligation Negotiation – If you decide that financial debt negotiation is your best alternative, CuraDebt works with your creditors in order to lower the quantity owed and produce a payment routine that fits you.

- Financial debt Combination – If consolidation of financial debt is your best option, CuraDebt collaborates with your creditors to consolidate all your financial obligations as well as integrate them into one monthly payment that you can manage, usually at a lower rate.

- Tax Obligation Financial Debt Relief – If you owe tax, CuraDebt will certainly help you negotiate a reduced quantity or established a budget-friendly settlement strategy with the IRS.

CuraDebt can assist you with your service debt combination if you are a small business owner that is struggling to repay the financial debt. They will certainly deal with your financial institutions in order to combine every one of your organization’s debts and make one monthly repayment that is convenient. This can aid you to return on the appropriate track economically.

CuraDebt’s total goal is to offer personalized financial obligation alleviation solutions that aid clients accomplish financial liberty as well as leave financial debt. CuraDebt supplies a free consultation to any individual fighting debt.

CuraDebt Debt Counseling advantages and disadvantages:

CuraDebt is no various. There are advantages and disadvantages. Take into consideration these advantages and disadvantages:

Pros:

- CuraDebt uses financial debt relief services that can aid you settle your debts much faster than if you attempted to do it yourself.

- CuraDebt aids you minimize your regular monthly payments by settling debts and discussing with financial institutions. This makes it much easier for you to handle your finances.

- CuraDebt has a group of professionals with over 20 years of experience in aiding little businesses and also people handle their financial debt. They have a record of proven success as well as are devoted to aiding customers to achieve monetary independence.

- CuraDebt provides a free assessment that is not bound by any type of obligation to help you better understand your financial obligation relief options.

- CuraDebt provides tax financial debt alleviation for people as well as local businesses.

CuraDebt can help small companies battling financial debt by combining their financial obligation.

Disadvantages:

- CuraDebt has costs that can differ relying on the specifics of your circumstance.

- Influence On Credit Report. Financial debt alleviation can negatively affect your credit history as it calls for discussing with creditors, and also perhaps changing the regards to finances.

- Not ideal for every scenario: Financial obligation relief might not be suitable for all circumstances. It’s vital to very carefully evaluate your choices before choosing to deal with a company that provides financial debt relief.

CuraDebt is a fantastic option for tiny businesses and individuals who are dealing with financial obligations. It is very important to consider the benefits and drawbacks of each choice and make a decision that is based on what you can manage.

To begin with CuraDebt, you can comply with these steps:

Arrange a Free Appointment: The primary step is to set up a free examination with CuraDebt. You can do this by visiting their website or calling their toll-free number. Throughout the consultation, a financial obligation alleviation specialist will review your economic scenario and give you tailored referrals for how to leave financial obligation.

Give Info: During the appointment, you’ll require to give information about your financial obligations, revenue, as well as costs. This will aid the financial obligation alleviation professional determine the very best strategy for your distinct scenario.

Choose a Debt Alleviation Program: Based on your economic scenario, the debt relief expert will suggest a debt alleviation program that’s right for you. This might consist of debt negotiation, financial debt loan consolidation, tax obligation debt alleviation, or organization financial obligation combination.

Authorize a Contract: If you decide to relocate forward with a debt alleviation program, you’ll require to sign an agreement with CuraDebt. This contract will certainly detail the regards to the financial debt relief program, including the fees you’ll be billed.

Beginning the Financial Obligation Relief Program: As soon as you have actually signed the contract, CuraDebt will certainly start functioning on your part to negotiate with your lenders or consolidate your financial debts. You’ll require to make payments to CuraDebt, which will after that distribute the funds to your financial institutions.

Generally, getting started with CuraDebt is an uncomplicated process that begins with a free assessment. If you’re dealing with debt, it may deserve to set up an examination to explore your choices for financial obligation alleviation.

Verdict

CuraDebt provides financial obligation alleviation solutions for people and also small companies struggling with financial debt. CuraDebt provides a range of services, including debt arrangement, loan consolidation, tax debt relief, and service financial debt settling, to help customers achieve financial liberty and obtain out of financial obligation.

CuraDebt offers numerous benefits, consisting of financial debt alleviation, reduced payments monthly, a skilled team, and a complimentary appointment. It additionally uses tax debt alleviation and company debt combination. There are some cons, consisting of fees, the prospective impact of financial debt relief solutions on your credit scores rating as well as that they might not be suitable for every situation.

If you are having a problem with financial obligation it deserves to discover your choices with CuraDebt. It’s essential to consider the advantages and disadvantages of each choice and also make a choice that is based on your monetary situation. Arrange a Free Appointment: